Best Locations to Place Vending Machines for Maximum ROI

- Abhishek Sharma

- 10 hours ago

- 4 min read

Great hardware helps, but vending machine placement ROI is won or lost at the site. The sweet spot is high-intent footfall on a natural “desire path,” short dwell time, cashless convenience, and refill access that doesn’t wreck margins. Below is a practical rubric you can copy, followed by the highest-yield locations and how to set them up for fast payback with Vendekin’s stack (UPI/RFID, multi-vend, elevator/frozen, and vNetra cloud).

The Placement ROI Rubric (score 1–5; target ≥17/25)

Footfall & Intent: How many people pass and how thirsty/hungry are they there?

Dwell & Throughput: Is there enough pause to browse, and can the queue move quickly?

Proximity & Visibility: On the desire path (corridor bend, lift lobby), eye-level screen visible.

Ops Access: Power point, network (4G/Wi-Fi), CCTV, and safe refill parking.

Governance Fit: Security, permissions, and a clear revenue/subsidy model.

Pro tip: log these scores in vNetra’s site notes and revisit after 30 days with live telemetry (AOV, payment success, stockouts).

Top 10 Locations That Consistently Return

1) Corporate Lobbies & Tech Parks (AOV leader)

Why it works: Constant footfall + card/UPI readiness.

Model: Combo 22 (22″ touch) for rich UX; multi-vend to keep queues short.

Planogram: Fast snacks + hydration; daypart promos (“Add water at ₹10 off”).

Expected lift: Highest basket size via cross-sell prompts.

2) Co-working Floors & Pantry Corridors

Why: Mixed tenants, frequent micro-breaks.

Model: Combo 10 (space efficient).

Payments: UPI + RFID staff wallets for entitlements.

Tip: Put within 10–15 m of meeting clusters.

3) Factories & Industrial Bays (time saved = money earned)

Why: Reduces walk-away time; supports PPE vending.

Model: Combo 10/22 + Elevend 22 for bottles/jars/lunch boxes.

Governance: RFID entitlements by department/shift; logs exportable.

Result: Faster payback from productivity gains + clean audits.

4) Hospitals & Clinics (compliance heavy, high intent)

Why: 24/7 traffic; hygiene expectations at hospital.

Model: Elevend 22 (gentle dispense) + multi-zone for chilled.

Planogram: Water, light snacks, OTC, hygiene; clear allergen info on 22″ UI.

Note: Keep within CCTV view; temperature logs via vNetra.

5) Universities & Hostels (late-evening demand)

Why: After-hours spikes; UPI native audience.

Model: Combo 10; add Frozen 22 at high-density halls.

Promos: Time-banded offers (evening study hours).

Tip: Ensure safe, lit placement near libraries/common rooms.

6) Gyms & Fitness Studios (peak bands, high hydration)

Why: Predictable rush pre/post sessions at gyms.

Model: Combo 10; protein + hydration bundles.

Tactics: Multi-vend carts; queue-speeding offers posted on mirrors.

7) Metro/Rail/Bus Concourse (throughput king)

Why: Massive footfall; low dwell UX must be instant.

Model: Combo 22 (large UI) or Elevend 22; anti-tilt alarms.

Payments: UPI QR at eye level, multi-vend on by default.

Ops: Refill off-peak; route clustering from vNetra OOS risk.

8) Multiplexes & Malls (weekend surges, family baskets)

Why: Big AOV potential, especially frozen/desserts.

Model: Frozen 22 + Elevend 22; clean front glass for impulse.

Promos: Movie showtime bundles; dessert upsell prompts.

9) Residential Clubhouses & Premium Housing

Why: Low CAC, repeat usage; community trust.

Model: Combo 10/22; hygiene + kids’ favorites.

Add-on: Society RFID or wallet credits; push “quiet hours” pricing if needed.

10) Training Centers & Tuition Hubs

Why: High repeat footfall; parents + students.

Model: Combo 6/10; healthy snacks + juices.

Tactics: Tutor partnerships; “exam week” offers.

Micro-Placement: The 5-Metre Rule

Within each site, location beats address. Use this checklist to avoid silent conversion killers:

Sightline: Screen visible from 8–10 m; not behind pillars or plants.

Desire path: Between lifts + cafeteria/exit; avoid dead ends.

Queue spill: 1–2 m clear in front; no fire exits blocked.

Power & signal: Dedicated 15A socket; test LAN/WIFI speed during peak.

CCTV coverage: Deters misuse and protects cashless optics (clean glass → faster scans).

Model Fit by Intent (cheat sheet)

Intent at Site | Best Model | Why it Maximizes ROI |

Fast hydration & snacks | Combo 10 | Density per sq. ft., quick refills |

Premium lobby discovery | Combo 22 (22″) | Bigger baskets via promos + info |

Fragile/premium items | Elevend 22 | Lower breakage, better UX |

Frozen desserts/heat-and-eat | Frozen 22 | Higher ticket, category expansion |

Budget test/new site | Combo 6 | Low capex, quick validation |

Payment & UX settings that lift ROI (flip these on Day 1)

UPI dynamic QR (PhonePe/GPay) at eye level; keep glass spotless.

RFID wallets where staff repeat-buy; enable time-window subsidies.

Multi-vend cart (1 payment, many items) to raise AOV and shrink queues.

Multilingual 22″ UI with allergen/macros for offices/hospitals.

Refill & Planogram discipline (comp is won here)

Start with a 60/40 split: proven top sellers vs. experiments.

In vNetra, check machine performance weekly; increase facings for winners, purge bottom 10%.

FIFO always; set expiry alerts for dairy/frozen.

Align refills to pre-peak windows and cluster routes by campus/park/line.

Quick ROI Math (plug your numbers)

Revenue/month = Tx/day × ASP × 22 working days Net Profit = Revenue − (COGS + logistics + payment fees + energy + routine care + software)

Revenue/month ≈ 65 × ₹30 × 22 = ₹42,900 Assume

COGS @ 68% and Other opex (logistics + payments + energy + routine care) ≈ ₹29,172 + ₹1,800 = ₹30,972

Net Profit/month ≈ ₹11,928

If capex (machine + setup) ≈ ₹1,60,000, then Payback ≈ 1,60,000 ÷ 11,928 ≈ 13.4 months

*Prices are indicative and may go up or down at time of purchase based on configuration, volume discounts, and market fluctuations.

30-60-90 Day Placement Plan

Days 1–30 (Pilot 3 sites): Baseline footfall, multi-vend + UPI/RFID, set daypart promos, log scores in vNetra.

Days 31–60: Move one underperformer by ≤5 m; swap bottom SKUs; add Frozen/Elevend where demand exists.

Days 61–90: Standardize pricing templates, lock best micro-placements, schedule quarterly reviews (AOV, stockouts, payment success, kWh).

Why operators choose Vendekin for placement ROI

Hardware breadth: Combo 6/10/22, Elevend 22, Frozen 22 = fit for any site.

Cashless rails: UPI + RFID that “just works,” clean reconciliations.

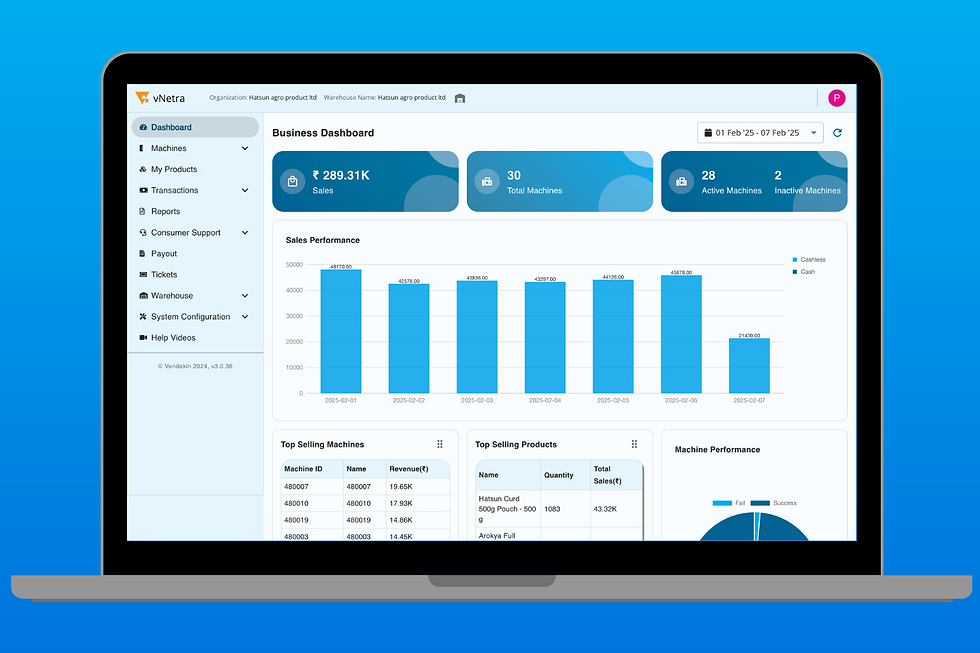

vNetra cloud: Telemetry, planogram intelligence, promo engine, OTA, and finance-ready reports.

Playbooks: From transit to factories, we’ve templated placements that pay back fast.

Conclusion & Next Steps

Winning vending machine placement ROI is about micro-geography, cashless UX, and data-led assortments - not luck. With the right cabinet, multi-vend + UPI/RFID, and vNetra optimizations, your best sites pay back in months and keep compounding.

Comments