How Digital Payments Are Transforming the Vending Industry

- Vendekin Team

- Aug 21, 2025

- 3 min read

Updated: Oct 7, 2025

The vending machine is no longer a metal box that eats coins it’s a real-time, tokenized payments endpoint at the edge. In 2025, vending machine digital payments sit where fintech meets IoT: multi-rail acceptance, instant settlement visibility, and identity-aware commerce, all wrapped in a 15–25 second user journey. Here’s how the rails, security, and data come together and why Vendekin is the preferred stack for operators and payment teams.

1) Payment Methods: The New Multi-Rail Reality

Modern kiosks must “meet the customer where they pay.” That means enabling several rails side-by-side and letting orchestration pick the best path.

UPI & Dynamic QR:

Ubiquitous, low-friction, and perfect for small tickets. Dynamic QR supports itemized receipts, coupons, and campus/enterprise flows.

RFID / Closed-Loop Cards & Badges:

Campus, factory, or office badges (RFID) enable identity-linked vending: subsidies, spend limits, and restricted SKUs with zero cash handling.

Cards (Chip + Cashless) & Pay-by-Link Fallback:

Keep rails resilient: when one fails, route to another without losing the session.

Vendekin advantage: Out-of-the-box support for UPI/QR, EMV cards, and RFID badges, with smart routing and real-time failure taxonomy to keep revenue flowing.

2) Cashless Is the Default Here’s Why

Faster Checkouts: Taps and scans cut queues and abandonment.

Cleaner Ops: No cash reconciliation, no shrinkage, instant settlement visibility.

Better Data: Every transaction is structured SKU, price, time, machine, location ready for analytics, promotions, and forecasting.

Hygiene & Trust: Zero cash handling

3) Security by Design (Edge to Acquirer)

Unattended terminals demand a defense-in-depth approach:

Payment Security: PCI DSS segmentation, P2PE terminals, remote key injection, and tokenization (network tokens for one-tap rebuys).

Device Hardening: Secure boot, signed firmware/containers, TPM/SE-backed keys, encrypted storage; remote attestation before enabling payments.

Risk Controls: Velocity limits (PAN/device), anomalies detection, offline counters for short outages with auto-reconcile.

Privacy & Compliance: PII minimization, scoped identity claims (OAuth/OIDC) for campuses/enterprises, audit trails and data-retention policies.

Vendekin advantage: Secure-boot kiosks, signed OTA updates, tokenized payments, and SIEM-ready logs plus configurable risk rules and offline-first safeguards.

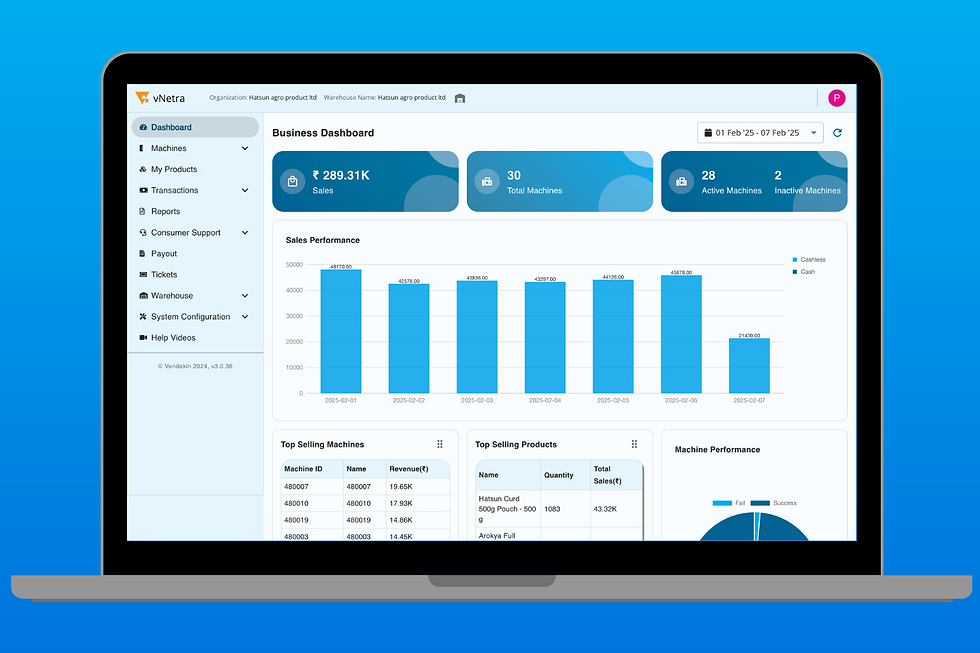

4) Cloud Dashboard (vNetra): Your Command Center

Digital payments turn vending into a measurable channel with Cloud dashboard (vNetra).

Live Telemetry: Auth rates, p95 payment latency per rail, vend success, stockouts, temperature, and device health.

Inventory & Pricing: Push price changes, promos, and bundles remotely; automate reorders from real sell-through.

Finance Workflow: Machine-level journals (select → auth → vend → dispense) simplify reconciliation and chargeback defense.

Vendekin advantage: A single pane for payments, inventory, and telemetry export to your BI lakehouse or plug into finance with APIs/webhooks.

5) Benefits by Stakeholder

Operators: Higher conversion, fewer truck rolls (predictive maintenance), dynamic pricing, and clean books.

Venue Owners: Better guest experience, 24×7 service without extra staff, revenue share transparency.

Fintech Teams: Real-time observability, smart routing uplift, and straightforward compliance posture at the edge.

6) Future Trends You Should Pilot in 2025

Identity-Linked Commerce: ID badges to unlock subsidies, entitlements, and restricted SKUs (e.g., staff-only items).

One-Tap Rebuys & Stored Credentials: Tokenized “buy again” flows increase repeat purchases.

Computer Vision Cabinets: Tap-to-unlock, take items, auto-charge frictionless micro-checkout for premium locations.

Contextual Pricing & Offers: Time-band or demand-based pricing with compliance guardrails; A/B test cross-sells on the screen.

Offline-First Payments: Local rules for tiny transactions keep lines moving during brief network dips, then sync.

7) Implementation Blueprint (Fintech-Ready)

Multi-Rail Acceptance: Enable UPI/QR, and RFID cards on day one; track auth% and p95 latency per rail.

Orchestrator & Token Vault: Route smartly, retry soft declines instantly, and store network tokens for rebuys.

Edge Hardening: Secure boot + attestation, TPM keys, signed images; block payments if integrity fails.

Observability: Stream events to your SIEM/APM; alert on auth dips, rail outages, or unusual decline patterns.

Reconciliation: SKU-level receipts with dispense sensors; T+1 settlement exports and variance alarms.

Vendekin advantage: Pre-integrated rails, orchestration hooks, RBAC dashboards, blue/green OTA.

Conclusion

Vending machine digital payments have turned kiosks into programmable, data-rich endpoints. Multi-rail acceptance, airtight security, and cloud analytics now define the category and separate leaders from laggards. If you’re a fintech builder or acquirer partner, the fastest path to higher auth rates, lower latency, and cleaner ops is a platform designed for unattended, edge commerce.

Sharing this comment to help others looking for trading values online. The tool provides clean and organized data, which makes it easier to compare fruits. It’s helpful for players planning fair trades or upgrades. No complicated steps involved. The BloxFruitsCalculator trading tool works well for regular in-game decisions.